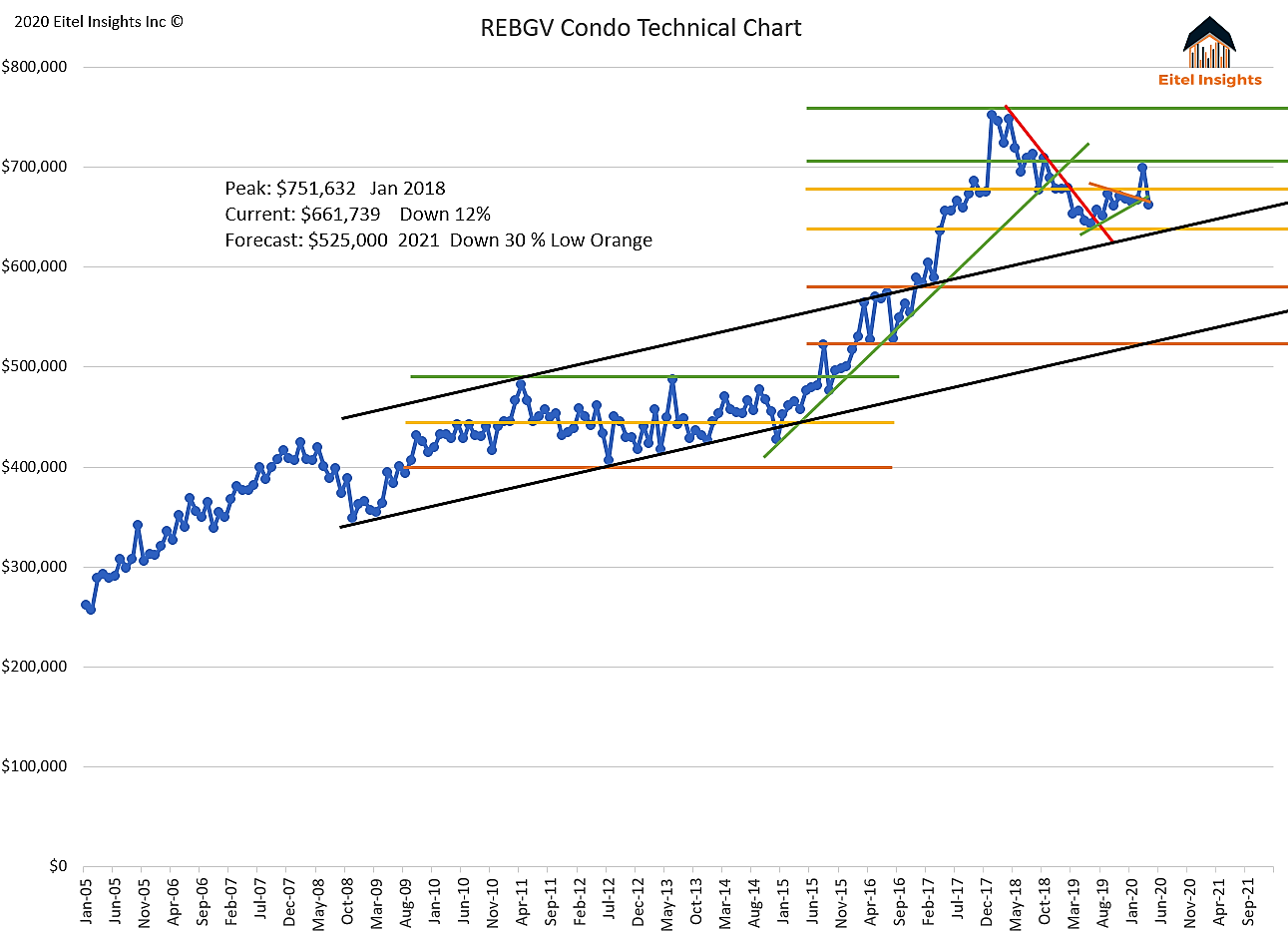

The newly active listings in September set another all-time high with over 3200 properties going up for sale. This marks the 6th straight month that newly active condos have doubled the sales totals. The oddity is the sales were loudly spoken of, but the new inventory was whispered. Prices were able to inch up despite a majority of the areas inside of the Greater Vancouver condo market off double digit percentage points, with 2 outliers being off 50%+ from their individual market peak’s.

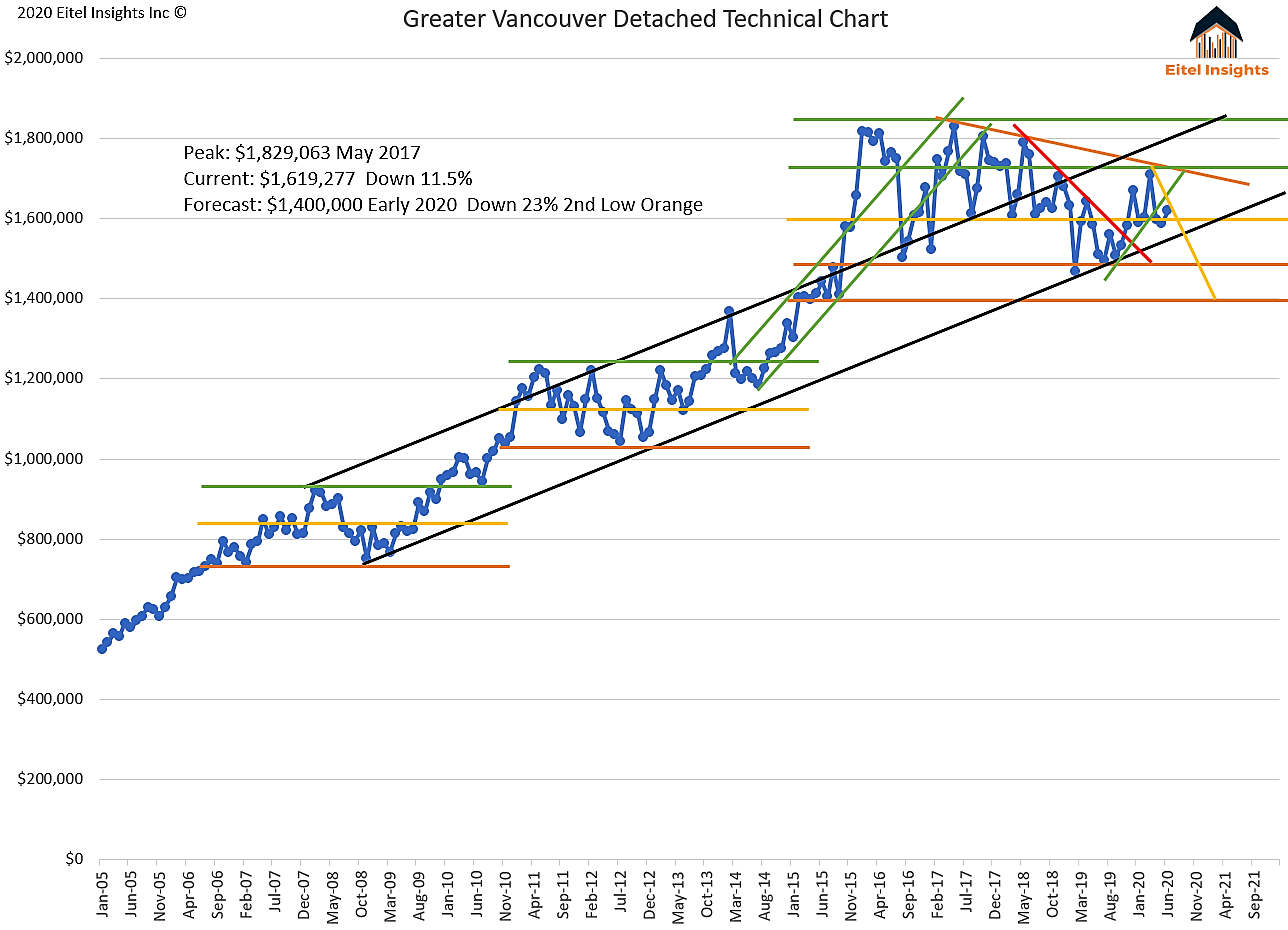

Prices have come down from the peak by 7%. The surprising part of this data point is, when you take the current data of the 19 regions which make up Greater Vancouver, there are 12 regions down 10%+ from their individual peaks. Of those 12, 5 of them are off 40%+. Understandably the Real Estate Boards recorded data kicks out an outlier or two to give accurate data. It is just surprising that the data indicates only a 7% drop from peak.

The data does have room to run higher before testing the possible downtrend. There could be room for some unusual price activity during the remaining portion of 2020 and into 2021. As those presale completions close. They will inevitably come to the market to be resold. Many will experience losses, some getting out by the skin of their teeth, and the fortunate will walk away with profits.

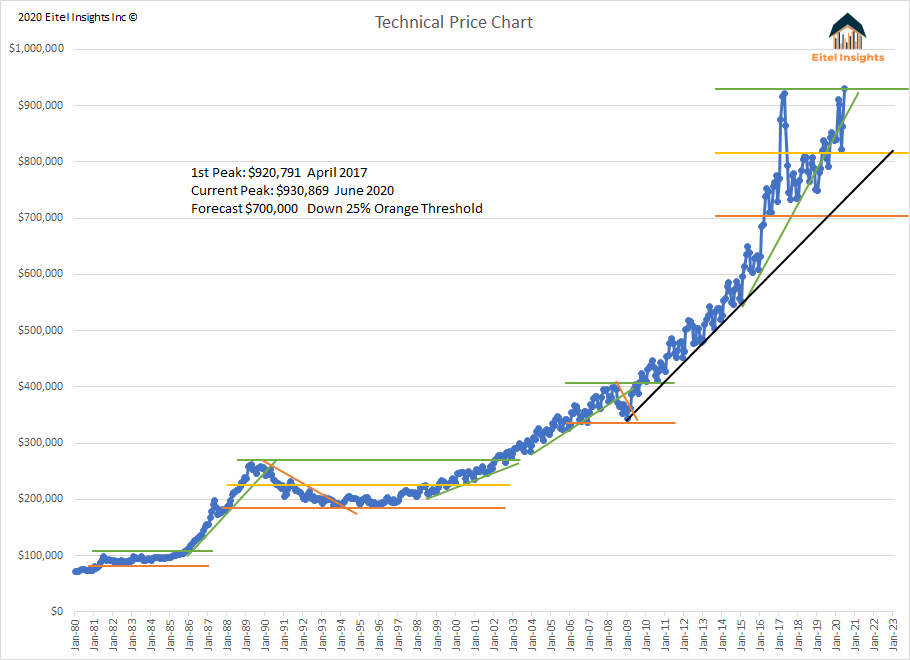

Technically speaking the downtrend indicated by the yellow line has never been tested since the inception, coupled with a second test to break above the upper echelon channel. The first attempt during March failed.

The preceding two years had clearly an up and down effect on prices. 2018 achieved peak prices with an average sales price of $751,632. 2019 prices fell more than $100,000 from the highs in 2018. Currently the 2020 prices are $50,000 higher than the low in 2019. The probably scenario is the market is creating lower highs coupled with lower lows which will see the market bottom occur during 2022.

Those presold condos could affect the data in a unique way over the short term. Presale prices do not count towards the MLS monthly average sale price data. Meaning those high valued, small square footage properties will be calculated into the average sales price for the first time. Even as the majority of sellers will lose based on their original purchase price, carrying costs, commissions, the high average sales price could bump the data higher, possibly even as high as the previous peak due to the artificially added value of high valued product newly added into the data metrics. If this does occur, this will likely be a temporary head fake. The growing need to sell has already pushed inventory to the highest levels in the past 5 years. Look at the price chart and the last time inventory was above 7000 actives, price action was very volatile, and could not propel beyond the technical price range. This is what will continue to occur over the upcoming 2021 and 2022 as inventory grows with the need to sell intensifying.

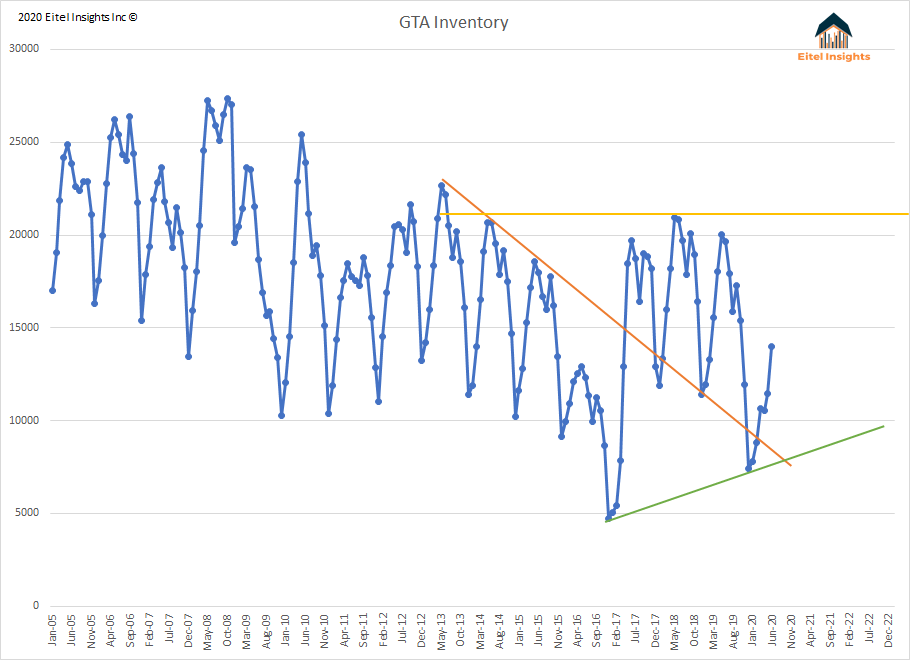

As mentioned active listings are at their highest point in the past 5 years. The seasonal norms, will likely take hold, but given that it is 2020 anything is possible. Due to the lockdowns during the spring the normal activity has been pushed back to later months. September ended with 6279 available condo listings.

The market has continued its record breaking ways again in September with over 3250 brand new listings on the market. Again seasonal norms should take hold, however over the upcoming two years the market is likely to experience 8000+ active listings, with a high probability of 9000 available units which would be an all-time high for Greater Vancouver.

The cannibalization of the market will begin after the majority of presales have completed. Once that occurs and inventory is 8000+, any unit in an older building will have very little chance of selling. The new warranties that come with the new buildings, along with the lower insurance fees, and just the overall new penny effect, will cause older units to be left with very little ammo in the chambers other than lowering their asking prices. This will ripple to the newer units, and the chase lower will have begun.

Sales did finally come through higher sales compared to the past 3 years. Which has had some perennial real estate bulls very excited. But only if you compare the data directly with past September’s. Not when you compare it to previous high water marks of any calendar year. The 1598 sales which took place in September did break out of the stagnant sales range, however when compared with previous years high water data points the sub 1600 sales is hardly anything to write home about, let alone be the headline. Add on the fact that there was the highest availability in 5 years and the newly active listings has doubled the sales for 6 months running. Eventually there will be a straw that breaks the condo’s back.