The city of Vancouver condo owners, especially investors have taken it on the chin recently. As mentioned in our last condo market update, Vancouver proper condo values were down to $861,000 in October. Then news broke, vacancy homes tax will triple to 3% for 2021. Fast forward a couple of weeks and the average sales price has dropped to $765,875. A $96,000 lost month over month. Doubtful the substantial decrease in prices resulted from the tax increase, which could be a sign of more losses to come during 2021.

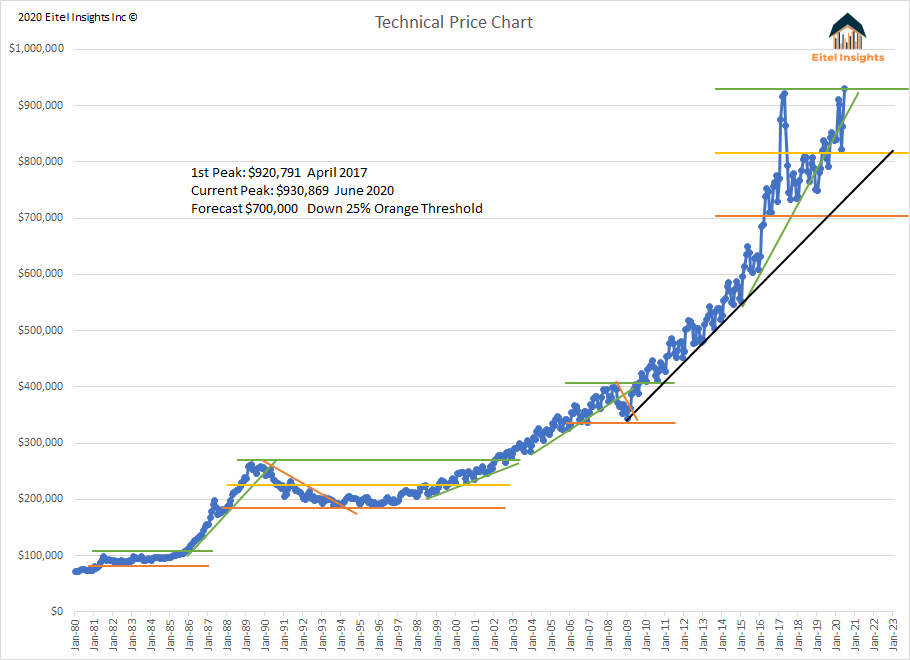

From zenith to current prices the city of Vancouver condo values have lost more than $325,000 (-30%). To be fair as evidenced by the chart below the sales price of $1.1M occurred for one month only. In the name of fairness, let’s take prices that were tested multiple times, and call that the peak: $970,000 (top green line). Using that as a true market top the losses are still substantial. The resulting loss after 3 years of ownership is $205,000. Also important is now that Vancouver prices being at $765,875, implies all previous gains since 2017 have been erased. As prices during Jan 2017 were $774,227.

The established losses, has resulted in the average price entering into the low echelon Eitel Insights forecasted market cycle. As noted previously, we believe the market cycle would test as low as $725,000-$775,000. With prices dropping to $765,000, many markets inside of Vancouver proper, are ripe for purchase. Especially for those who are planning to owner occupy.

At current price levels, owner occupied purchasers who have been advised to wait by Eitel Insights can finally begin to hunt for purchases. With many areas inside of Vancouver entering into their forecasted market lows, signals excellent purchasing opportunities based on our analytical interpretation.

A 10% drop from peaks is considered a correction, a 20% is a recession, and 30% drop has no definition other than, “ouch”. From the zenith to current levels condo values have dropped 30%. The true peak of prices occurred during Feb and April 2018 at $970,000 (top green line) indicating a 21% loss. Any way you slice it the city of Vancouver’s condo market has hit recession levels.

Point of interest. After a significant trend line is broken as is the case for the city of Vancouver price chart, the market tends to become volatile for a short period. This could result in some wild swing in the price chart. These swings could result in prices temporarily returning to the middle threshold or hurl prices to the lowest edge of the market threshold. Over the longer term, the break of the uptrend will likely result in condo values selling in the lower half of the market cycle, until the market consolidates prices with a forecasted bottom between of $725K - $775K range.

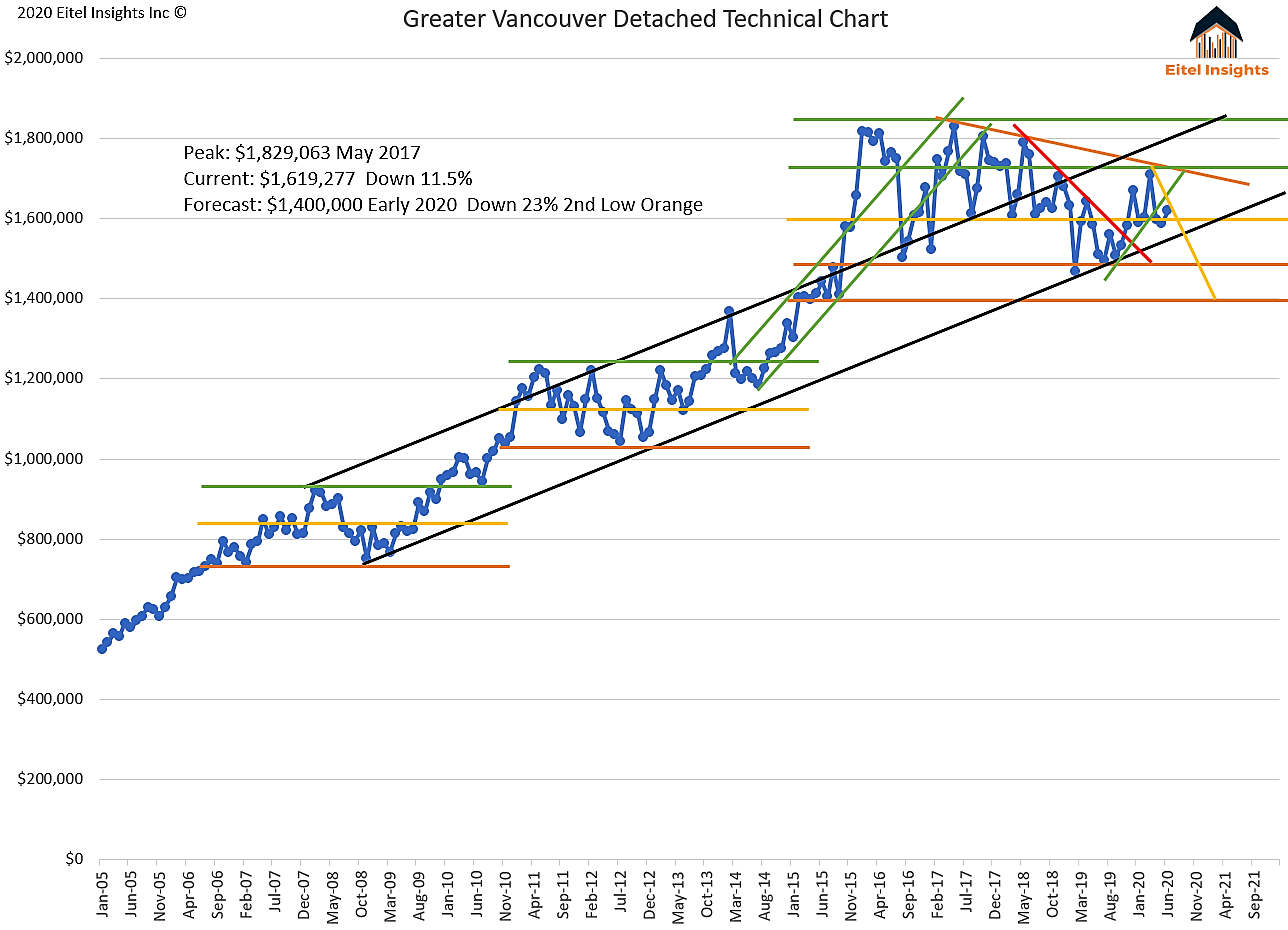

Greater Vancouver overall, broke its’ uptrend as well. Condo values dropped to $657,000 indicating a 13% drop from the peak in prices. As stated after a trend is broken, volatility is likely to ensue in the short term. This volatility could result in Greater Vancouver prices possibly rising back up in an attempt to regain position inside of the uptrend, or could send prices down to test the low yellow threshold which is the near term low of $635,000.

If prices do decrease to $635,000 in the short term, that would create a very important test to the upper echelon of the prolonged uptrend (top black uptrend). Prices will likely find near term support based on the prolonged trend. Once the upper threshold of the prolonged uptrend breaks the overall condo market will experience intense volatility.

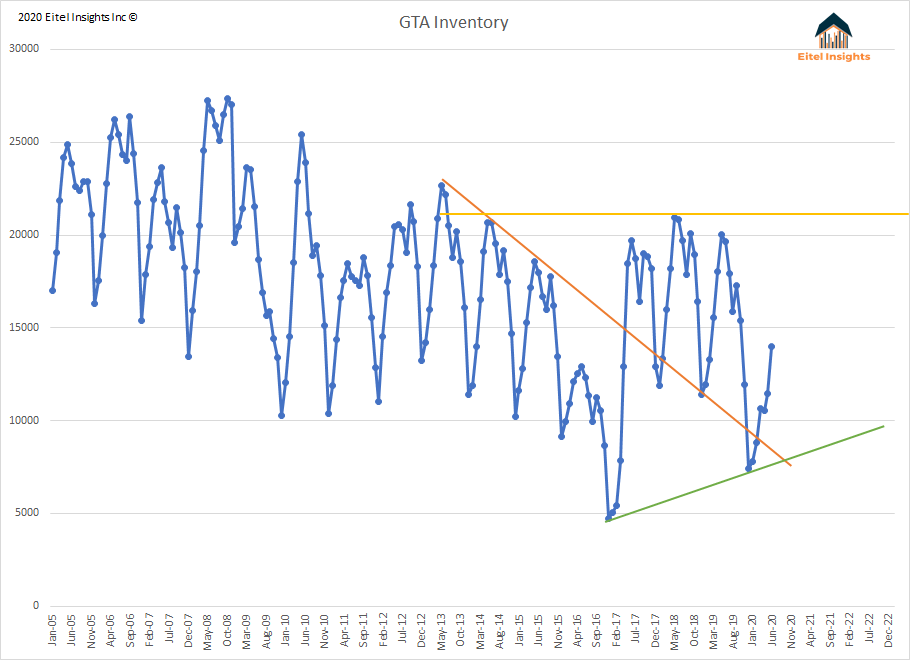

The overall condo inventory for Greater Vancouver during November was 5,669 active listings. At that level the data is challenging the yearly uptrend. It would be an odd occurrence if inventory increases during the month of December. However, during 2020, seemingly anything is possible.

During 2021 Eitel Insights anticipates inventory levels to surpass the 7,000 active listings a feat not accomplished since 2014. With the new additions from the completed presale, the notion of the total inventory surpassing 8,000 is a real possibility as well.

Sales dipped back into the established downtrend and low sales channel during November. The total sales were 1,373. There has been a clear cut difference between the detached and condo purchasing mentality that was born out of the Covid pandemic. The pulled forward demand never arrived in the condo market. The rise in data was merely the pent up demand experienced during the initial lock down. As more and more inventory is brought to the market at decreased price point, the notion of overpaying for a depreciating asset will result in buyers becoming hesitant to purchase. This will exacerbate the supply demand dynamics, which have been changing from the sellers favour to the buyer.

As the overall market indicates the Greater Vancouver condo market is in the middle of the projected market cycle and down 13%. While areas inside of Vancouver proper have dropped closer to 30%.

Individual markets inside of Greater Vancouver prices, and trends vary. To receive actionable intelligence for your personal or investment property become and Eitel Insights client.